Shield Your Assets with Offshore Company Formation Strategies

Wiki Article

Comprehending the Trick Benefits of Offshore Company Formation for International Entrepreneurs

Offshore Company Formation offers significant advantages for international entrepreneurs. It provides boosted tax efficiency, possession protection, and raised personal privacy. In addition, these companies make it possible for access to new markets and streamline operations. Entrepreneurs might locate that developing an overseas existence not just safeguards their riches yet also boosts their service integrity. Recognizing these benefits is essential for those aiming to grow in a competitive landscape. What various other factors should entrepreneurs take into consideration in their tactical preparation?Enhanced Tax Efficiency

Boosted tax obligation efficiency is among the key benefits of forming an overseas Company. Business owners commonly look for territories with desirable tax programs, which can considerably minimize their overall tax obligation responsibilities. By establishing an offshore Company in a low-tax or tax-exempt location, local business owner can gain from reduced business tax rates, minimized capital gains tax obligations, and possible exceptions on specific types of income.This tactical financial planning permits for reinvestment of even more funding back right into the organization, cultivating development and expansion. Additionally, many overseas territories offer structured processes for tax obligation conformity, which can conserve time and sources for service owners.The capability to delay tax obligations through cautious structuring can better boost cash money circulation, giving extra versatility for investment. On the whole, improved tax obligation performance not only adds to improved earnings however also positions businesses to thrive in the affordable global market.Property Defense and Protection

Offshore Company Formation offers significant advantages in property security and safety and security. By creating a legal shield versus creditors, people can secure their riches while taking pleasure in enhanced privacy and privacy. Additionally, branching out assets via offshore entities can further minimize dangers and boost monetary security.Legal Shield Versus Creditors

Protection against financial institutions stands as a vital benefit of overseas Company Formation, supplying people and organizations with a durable layer of defense for their assets. By establishing an overseas entity, business owners can efficiently secure their wide range from prospective lawful insurance claims and lender activities. This lawful guard enables the separation of individual and company possessions, lessening the risk that lenders can access personal sources in the occasion of organization responsibilities. Offshore jurisdictions frequently feature favorable laws that improve possession protection, making it difficult for creditors to pursue financial obligations. This tactical Formation not only promotes monetary safety but likewise promotes peace of mind, allowing entrepreneurs to focus on company growth without the looming danger of financial institution treatment.Personal Privacy and Privacy Conveniences

Regularly, people and businesses seek the advantages of privacy and privacy when forming offshore firms, identifying its substantial duty in property security. By making use of overseas jurisdictions, entrepreneurs can secure their identities from public scrutiny, thus decreasing the risk of targeted lawsuits or monetary liabilities. Privacy provisions in numerous overseas areas ensure that Company ownership and economic details stay unrevealed, using a layer of safety against prospective creditors and plaintiffs. This privacy not only protects private assets however additionally promotes a feeling of safety and security that encourages investment and entrepreneurial development. Eventually, the capacity to operate quietly can boost tactical decision-making and long-lasting planning, enabling company owner to focus on development without the constant risk of direct exposure or vulnerability.Diversity of Assets Technique

When companies and people look for to protect their wide range, a diversification of possessions strategy ends up being important. Offshore Company Formation provides a useful method for attaining this objective. By developing entities in numerous jurisdictions, entrepreneurs can spread their investments across different asset classes and areas, therefore decreasing danger direct exposure. This approach not only safeguards versus localized economic slumps however also enhances financial safety and security by leveraging desirable tax programs and regulative atmospheres. Furthermore, offshore business can provide legal protections that shield properties from financial institutions and political instability. By doing this, a well-structured overseas portfolio can work as a necessary part of a comprehensive asset protection plan, making certain the sustainability and development of riches in a progressively unpredictable global landscape.Increased Personal Privacy and Privacy

Boosted privacy and confidentiality are substantial benefits of offshore Company Formation. Enhanced information security measures assure that delicate info remains secure, while privacy in ownership safeguards the identities of stakeholders. These variables contribute to a much more very discreet organization atmosphere, appealing to those seeking to safeguard their monetary and personal events.Enhanced Information Security

How can offshore Company Formation enhance information protection? By establishing a firm in territories with strong information protection laws, business owners can benefit from improved safety and security measures - offshore company formation. Offshore companies commonly have access to durable governing structures that prioritize information personal privacy, guaranteeing that delicate details is secured against unapproved access and violations. Furthermore, these territories might enforce rigorous fines for information mishandling, engaging companies to embrace ideal methods in data administration and protection. This aggressive method not only guards business operations yet also cultivates depend on amongst partners and customers. As an outcome, global business owners can concentrate on growth and technology, confident that their information continues to be protected in a safe setting. Enhanced data security therefore comes to be a necessary aspect of offshore Company Formation

Anonymity in Ownership

While several company owner seek to shield their individual information, the privacy used by offshore Company Formation gives a sensible service. This level of privacy is appealing for business owners who click here wish to shield their identifications from public scrutiny, rivals, and prospective litigants. Offshore territories usually enable nominee solutions, where 3rd parties are appointed to represent ownership, additionally enhancing discretion. By utilizing these frameworks, company proprietors can conduct their procedures without the worry of individual exposure. In addition, anonymity can secure against identification theft and unwanted solicitation. Overall, the privacy afforded by overseas Company Formation not just safeguards personal information however likewise fosters a protected environment for organization tasks, motivating business owners to pursue worldwide possibilities with confidence.

Accessibility to New Markets and Opportunities

What benefits can offshore Company Formation bring to businesses seeking to expand their reach? Offshore Company Formation opens doors to brand-new markets, permitting entrepreneurs to profit from emerging possibilities around the world. By establishing a visibility in territories with favorable profession arrangements, firms can access varied consumer bases and enhance their market share.Additionally, offshore entities can take advantage of minimized regulative obstacles, making it possible for easier entry right into international markets. This strategic positioning enables organizations to adjust to regional choices and obtain an affordable edge.Furthermore, firms can take advantage of positive tax obligation routines and rewards used by overseas jurisdictions, enhancing their success and reinvestment abilities.

Simplified Business Procedures

By developing an offshore Company, businesses can streamline their procedures, causing enhanced performance and reduced administrative problems. Offshore territories typically offer straightforward treatments for Company registration and recurring conformity, decreasing taxing paperwork. This simplification allows entrepreneurs to concentrate on core tasks as opposed to navigating via facility regulations.Additionally, several offshore locations offer access to sophisticated technical framework, allowing organizations to utilize electronic tools for communication and procedures. This boosts performance by helping with much easier cooperation and remote management.Furthermore, the ability to operate in a stable economic environment with beneficial tax policies can result in much better monetary planning. In general, overseas Company Formation not only relieves operational processes however additionally sustains strategic growth initiatives. As a result, businesses can allocate sources better, driving technology and competition in the worldwide market.Versatility in Compliance and Regulation

Offshore Company Formation uses substantial adaptability in compliance and law, enabling companies to tailor their procedures to satisfy certain needs. This flexibility is specifically beneficial for business owners seeking to navigate varied legal settings. Lots of offshore territories give structured regulatory frameworks, reducing governmental obstacles and allowing companies to focus on core activities.Furthermore, the ability to pick details governing requirements can boost operational performance. Entrepreneurs can pick jurisdictions that straighten with their company approaches, choosing for marginal reporting commitments or beneficial tax obligation programs. This adaptability not only help in expense management but likewise encourages technology, as companies can pivot without being overloaded by stringent neighborhood regulations.Additionally, offshore business typically gain from privacy and discretion stipulations, better enhancing their functional discretion. As an outcome, entrepreneurs are encouraged to create personalized conformity frameworks that straighten with their unique purposes, eventually cultivating a more dynamic organization landscape.Improved Organization Reliability and Reputation

A substantial benefit of forming an overseas Company is the improvement of company integrity and reputation. By establishing a visibility in a trustworthy jurisdiction, entrepreneurs can forecast a photo of professionalism and legitimacy. This perception is frequently reinforced by the high criteria and rigorous laws promoted by several overseas places. Partners and clients might watch offshore business as even more trustworthy, which can help with smoother organization deals and foster lasting relationships.Moreover, being associated with a recognized overseas monetary center can attract capitalists and consumers who prioritize reliability. It also permits organizations to utilize the special advantages of the territory, such as tax obligation benefits and access to international markets. This combination of boosted reputation and critical positioning can result in increased possibilities for development and growth. Ultimately, improved service credibility functions as a vital element in establishing an affordable edge in the global industry.Regularly Asked Concerns

Exactly How Does Offshore Company Formation Affect Individual Responsibility for Entrepreneurs?

Offshore Company Formation substantially minimizes personal responsibility for entrepreneurs by developing a legal separation in between personal possessions and organization responsibilities (offshore company formation). This framework safeguards people from personal monetary risks related to company financial obligations and legal casesWhat Are the Usual Misconceptions About Offshore Business?

Can Offshore Business Be Used for E-Commerce Businesses?

Offshore companies can without a doubt be utilized for ecommerce businesses. They use benefits such as tax advantages, personal privacy, and accessibility to global markets, making it possible for entrepreneurs to operate successfully and competitively in the digital landscape.What Are the Preliminary Prices of Establishing an Offshore Company?

The first costs of setting up an overseas Company usually include enrollment costs, lawful expenses, and ongoing compliance expenses. These expenditures can differ significantly based upon jurisdiction, organization framework, and details solutions required for unification.Exactly How Can Entrepreneurs Pick the Right Offshore Jurisdiction?

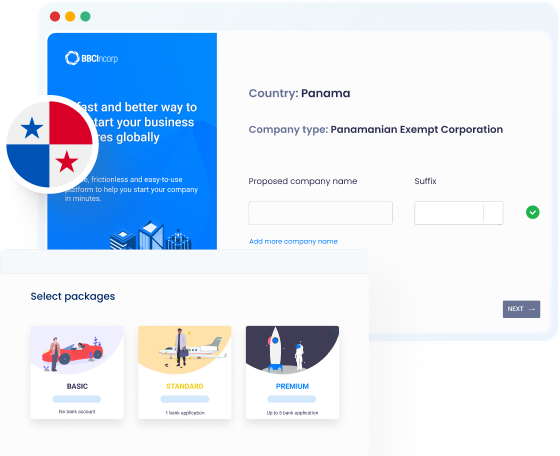

Entrepreneurs can choose the right offshore jurisdiction by reviewing factors such as tax rewards, regulative atmosphere, political security, convenience of operating, and accessibility of expert solutions, making certain alignment with their business goals and functional demands. By developing an overseas Company in a low-tax or tax-exempt area, business owners can benefit from lower corporate tax obligation rates, minimized resources gains tax obligations, and prospective exemptions on certain types of income.This critical monetary planning allows for reinvestment of more resources back right into the organization, cultivating development and expansion. Safety and security against creditors stands as a critical advantage of overseas Company Formation, supplying people and businesses with a robust layer of security for their possessions. While several business owners seek to safeguard their individual details, the privacy provided by overseas Company Formation supplies a sensible remedy. Clients and companions may see offshore business as more trustworthy, which can assist in smoother company deals and foster lasting relationships.Moreover, being connected with a revered overseas monetary center can attract investors and clients who prioritize integrity. Offshore Company Formation considerably minimizes personal obligation for entrepreneurs by producing a lawful separation in between personal possessions and business commitments.Report this wiki page